Video #1

- There are 3 different types of money

- Commodity Money

- Money that serves as other things

- Most primitive/basic type

- Goods that represent other goods

- Representative Money

- Represents a specific quantity backed by a precious metal

- Drawback is when the value of the metal changes, so does the value of the national currency

- Fiat Money

- Money not backed by metal

- Money that is backed by the word of the government

- "Because the government says so"

- Function of Money

- Medium of Exchange

- "It is through money that exchange happens"

- Store of Value

- When you put money away

- The value is still the same

- Unit of Account

- Look at price (implies worth) to the quality

- The price of good/service (quality wise) should be expected

- The more you spend the better it is

- used to judge based on the value of the quality

Video #2

As price increase, quantity decreases

As price decrease, quantity increases

SM does not vary on interest rate; it is fixes or set by the Fed

An increase in demand puts pressure on interest rate

To bring the interest rate down, Fed can increase the money supply

If the money supply is unstable, they cannot predict the level of investment, cannot predict consumer spending, thus cannot manipulate aggregate demand.

Video #3

Expansionary (easy money)

- Decrease the Reserve Requirement

- Decrease the Discount Rate

- Buy Bonds (increase the money supply)

Contradictory (tight money)

- Increase the Reserve Requirement

- Increase the Discount Rate

- Sell bonds (reduces the money supply)

The Reserve Requirement is the amount of money the bank must keep as vault cash or as reserve on a Fed branch

When the RR is low, the RR money becomes Excess Reserves to make loans

When you raise the RR, there is less money for the bank to loan out

Banks lended out to much money that led tot he Great Depression

The Federal Fund Rate is the rate at which banks borrow from each other

The DR is the rate at which banks can borrow from the Fed

- Lenders of last resort

- Not that effective or popular (not guaranteed"

- "Buy bonds=Big Bucks"

Video #4

SLF is the amount of money people have in banks; depends on savings

Example-when the government runs a deficit

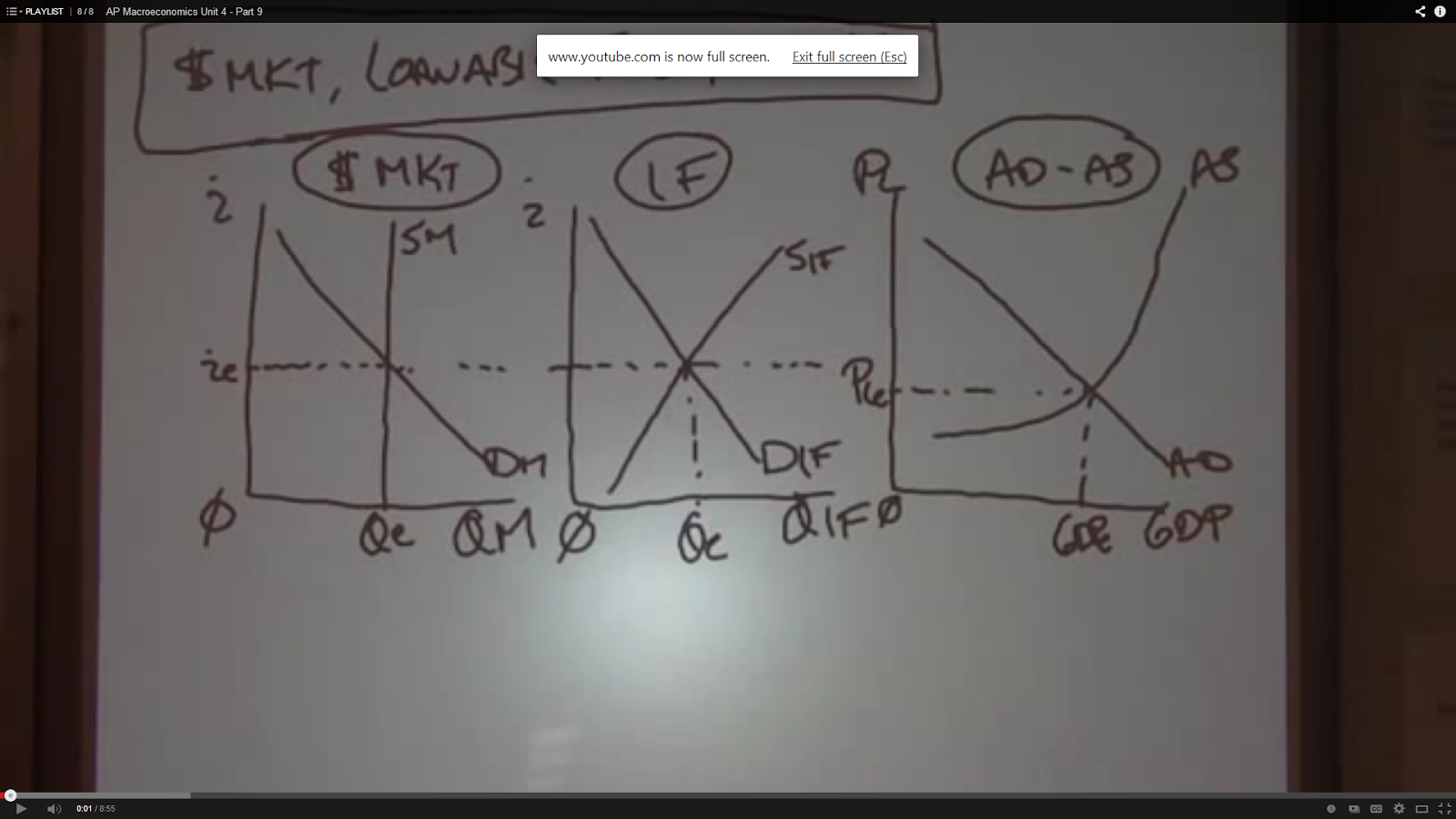

As the demand for money increases in the loan-able funds "market", so does the supply of money in the money market

If the government is in a deficit:

Then it demands money, it jacks up the interest rate, and Decreases supply to increase interest rate

Both cause the same change

Video #5

Money is created by making loans

Money multiplier is 1/RR

Example: RR=20%, bank make a loan amount of $500

1/.2=5

5*loan; 5*$500=2500

Bob gets 500, puts it in a bank

Loan to Joe, $400 (transfers to bank)

Loan to Suzy, $320 (transfers to bank)

If continued until it went to zero, then the added total should be $2500

Does not guarantee $2500 because it goes on the assumption that there are no excess reserves.

Video #6

In a deficit, the government borrows from others

Mostly borrows from its people

To show change in LF

- Increase demand

- Reduce national available supply

Change is the same in all graphs

MV=PQ

A change in M causes a change in P

The fissure effect is that the change in the interest rate and the Pl have to be equivalent

Well dang Franciso. I've never actually been to your blog yet but well done. Really great job on all of the imagery - it can get daunting to see so much text and not see a breather every once in a while. Excellent job with the notes, images, and everything really. I'll be stealing your blog shortly.

ReplyDelete